UK aesthetic clinics are increasingly faced with scrutiny from HM Revenue & Customs (HMRC) regarding Value Added Tax (VAT) charges on cosmetic treatments. A significant change introduced in 2010 suggested that elective cosmetic treatments without medical justification must include VAT. However, the guidance also left substantial ambiguity around differentiating medical from purely cosmetic procedures. This regulation created a state of confusion and compliance challenges for clinics. Recent intensified HMRC investigations highlight the serious financial and operational implications of this ambiguity for aesthetic practitioners.

Apart from the downside for pricing and consumers VAT registration also has its upsides which we will also explore later.

Overview of the 2010 VAT Rules

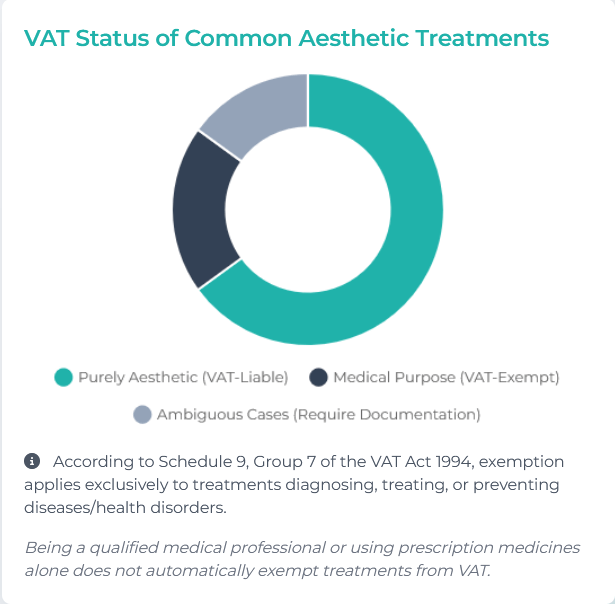

In the UK, VAT rules specify that healthcare services are exempt only if they qualify explicitly as “medical care.” According to Schedule 9, Group 7 of the VAT Act 1994, this exemption applies exclusively to treatments diagnosing, treating, or preventing diseases or health disorders. Cosmetic procedures performed purely for aesthetic reasons do not meet these criteria and thus are subject to the standard 20% VAT.

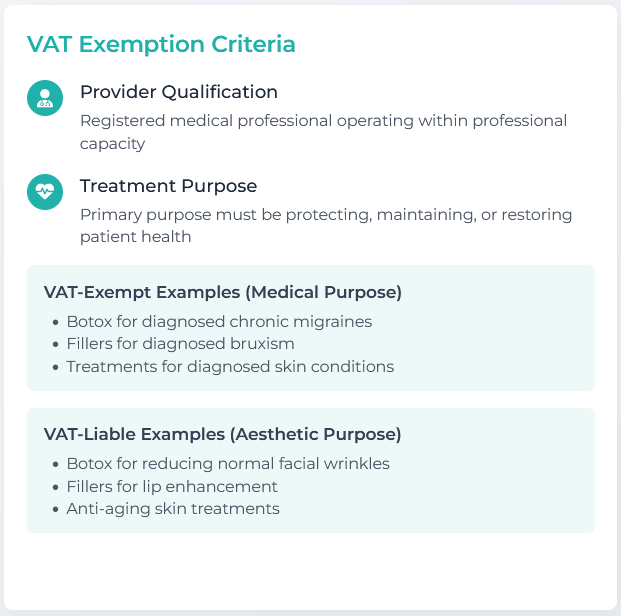

The law outlines two main conditions for VAT exemption:

- The provider must be a registered medical professional operating in their professional capacity.

- The primary purpose must be protecting, maintaining, or restoring patient health.

Treatments like Botox and dermal fillers may qualify for VAT exemption if used to address a diagnosed medical issue, such as chronic migraines or bruxism. Conversely, treatments aimed solely at improving appearance—like reducing normal facial wrinkles—must include VAT.

Recent HMRC Enforcement Actions

Since 2019, HMRC has significantly increased enforcement actions, actively inspecting aesthetic clinics for compliance. Several high-profile tribunal cases have highlighted the substantial risks involved:

- Skin Rich Clinic (2019): This case emphasized that Botox treatments for purely aesthetic purposes are subject to VAT, resulting in approximately £21,000 in owed VAT.

- Illuminate Skin Clinics (2023): The tribunal ruled that treatments were taxable because they lacked documented medical justifications. Patients self-referred for cosmetic goals rather than for medically diagnosed conditions.

- Aesthetic-Doctor.com (2023): HMRC successfully demanded a wooping £1.6 million in backdated VAT, dating from 2010. The tribunal concluded treatments aimed primarily at appearance enhancement did not qualify as VAT-exempt medical care.

These decisions proved that being a qualified medical professional or using prescription medicines alone does not automatically exempt aesthetic treatments from VAT.

Clinics not adhering to the VAT rules risk substantial financial penalties, including backdated tax bills. But one of the worst aspects is that the fines can be potentially equal to the unpaid VAT. Non-registered clinics are particularly vulnerable, facing liabilities potentially extending back many years. For many an enforcement action would lead to immediate bankruptcy.

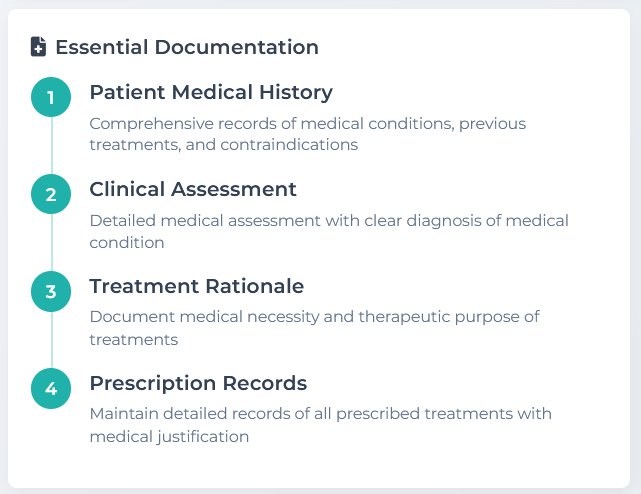

The subjective nature of determining medical necessity complicates compliance. HMRC has consistently stated that improving self-confidence or appearance alone does not meet the medical exemption criteria. Clinicians must provide robust, documented evidence of medical necessity to claim exemption, including patient assessments, clinical diagnoses, and detailed treatment rationales.

Recommendations for Clinics

Given all this increased scrutiny, aesthetic clinics should clearly differentiate and document medically necessary treatments as opposed to purely cosmetic procedures. Maintaining comprehensive patient records that include diagnoses, clinical notes and medical justifications for all treatments is key. Clinics should regularly consult with VAT specialists to ensure ongoing and accurate compliance with HMRC regulations.

Industry bodies, such as BAAPS and BCAM, advocate for clearer HMRC guidance, emphasizing the importance of psychological and emotional well-being aspects inherent in some aesthetic treatments. Internationally, VAT treatment for cosmetic procedures varies, though most jurisdictions align broadly with the UK’s position: purely cosmetic procedures are taxable, while treatments with verified medical purposes are exempt.

Becoming VAT registered is not all bad. It can offer several notable benefits for aesthetic clinics. VAT registration enables clinics to reclaim the VAT paid on various business-related expenditures, including marketing, advertising, equipment purchases and professional fees. This can significantly lower the overall operating costs of the clinic, particularly beneficial when investing in promotional activities or technological advancements. Compliance may initially seem burdensome but VAT registration can also provide some financial advantages.

Caution advised

Aesthetic clinics in the UK must proactively address VAT compliance to mitigate financial and operational risks. Clear documentation, professional advice and transparent patient consultations are essential. Clinics should carefully assess each treatment on a case-by-case basis, ensuring robust evidence of medical necessity is available to withstand potential HMRC scrutiny.