The UK’s aesthetic industry has witnessed explosive growth in the last 10 years. We know that non-surgical cosmetic treatments are now widely available across a variety of regulated and unregulated settings. From independent injectable clinics to high-street beauty salons, the availability of treatments such as Botox, dermal fillers, and skin rejuvenation procedures continues to increase. Yet with this expansion comes complexity, especially in understanding the scope and structure of the industry. So we try to answer the big question of how many clinics exactly do we have in the UK.

According to the British College of Aesthetic Medicine (BCAM), 6,117 Care Quality Commission (CQC), registered clinics currently offer aesthetic procedures, accounting for roughly 12% of the total 51,616 CQC-regulated healthcare providers across the UK. These are formally recognised and subject to medical regulatory oversight. However, this figure tells only part of the story.

A 2023 University College London (UCL) study examining 3,000 websites identified 1,224 independent clinics offering injectable treatments, suggesting the growing presence of specialist providers operating outside hospital or traditional healthcare environments.

When it comes to practitioners themselves, the picture becomes even more layered. Save Face, an accredited register, listed 851 registered aesthetic practitioners as of January 2024, while data from insurance provider PolicyBee estimates a wider pool of 7,892 licensed aesthetics professionals across the UK.

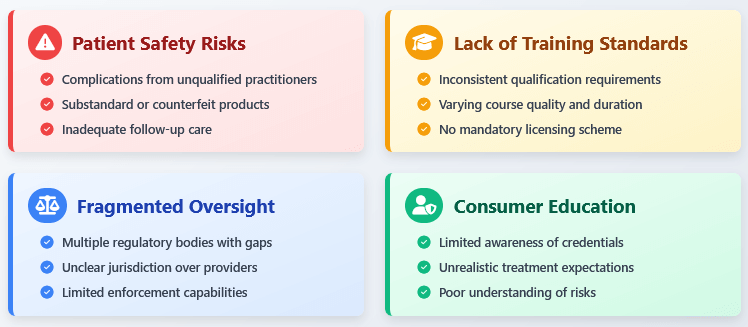

These figures reflect only the regulated segment. Crucially, the BCAM report suggests there may be as many as three unregulated providers for every regulated one. This implies the existence of up to 18,351 additional unregulated treatment providers. Certainly a figure that raises a few eyebrows and brings clear questions about patient safety and standardisation.

The beauty salon sector adds another dimension. Of the 10,675 beauty salons recorded in 2021, a growing proportion now offer aesthetic services. While precise numbers are elusive, UCL’s study found that around 12% of injectable providers were aestheticians or aesthetic therapists, many likely operating within beauty salons. There are further reports of 3,924 dedicated aesthetic clinics across the country. This number is excluding those salons where aesthetic procedures are offered alongside traditional beauty treatments.

Industry Challenges

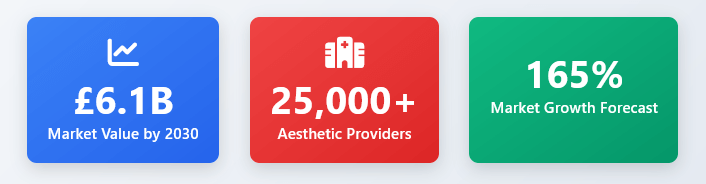

Combining data from regulated clinics, unregulated operators, and the beauty sector, estimates suggest there are between 24,000 and 25,000 establishments in the UK providing non-surgical aesthetic treatments. While overlap is likely, for example, a beauty salon might also register as a dedicated aesthetic clinic. These figures show the scale and reach of the industry, much of which operates beyond the scope of direct regulation.

From a strategic marketing perspective, the UK’s aesthetic industry presents a highly competitive landscape. With an estimated 25,000 aesthetic providers operating across the country, the average clinic serves approximately 2,782 people. But this number shrinks significantly when segmented by key demographics, with each clinic catering to just 1,412 women or 2,206 adults on average. A dense provider-to-patient ratio, particularly among women, with roughly 71 clinics available per 100,000 females. For marketers, this shows the need for hyper-targeted positioning, brand differentiation and trust-building strategies to stand out in an increasingly crowded space. The data also shows the importance of demographic segmentation and localised campaigns, especially in areas where competition per capita may be even more intense.

| Metric | Value |

| Assumed Number of Aesthetic Clinics | 25,000 |

| Total UK Population (2025 estimate) | 69,551,332 |

| Female UK Population (2025 estimate) | 35,294,351 |

| Adult (18+) UK Population (2025 estimate) | 55,153,006 |

| Clinics per Person Metrics: | |

| Clinics per 100,000 People | ~35.94 clinics |

| Clinics per 100,000 Women | ~70.83 clinics |

| Clinics per 100,000 Adults (18+) | ~45.33 clinics |

| Population per Clinic Metrics: | |

| Average Number of People per Clinic | ~2,782 people |

| Average Number of Women per Clinic | ~1,412 women |

| Average Number of Adults (18+) per Clinic | ~2,206 adults |

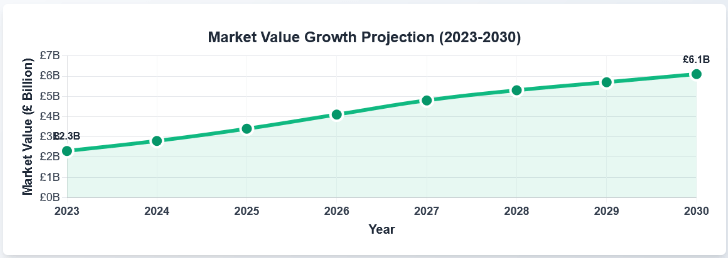

Amidst this expansion, the UK non-surgical aesthetics market was valued at £2.3 billion in 2023 and is projected to reach £6.1 billion by 2030, according to Grand View Research. With this growth trajectory, calls for tighter regulation and practitioner accountability are intensifying, particularly to address the risks posed by unregulated providers. Save Face, BCAM and other industry players have been campaigning for stricter regulation in the industry for a considerable amount of time. Yet, they seem to be losing the battle, especially after a case of a BMA Challenge against the GMC about what a “medical professional” is.

The UK aesthetic sector continues to evolve at a fast pace, driven by consumer demand, social media influence, and expanding treatment offerings. However, its structural complexity, marked by a fragmented mix of clinical and commercial providers, presents both opportunity and challenge. As the market matures, ensuring patient safety and consistent care quality will depend increasingly on clearer regulation, robust training pathways, and better-informed consumers.